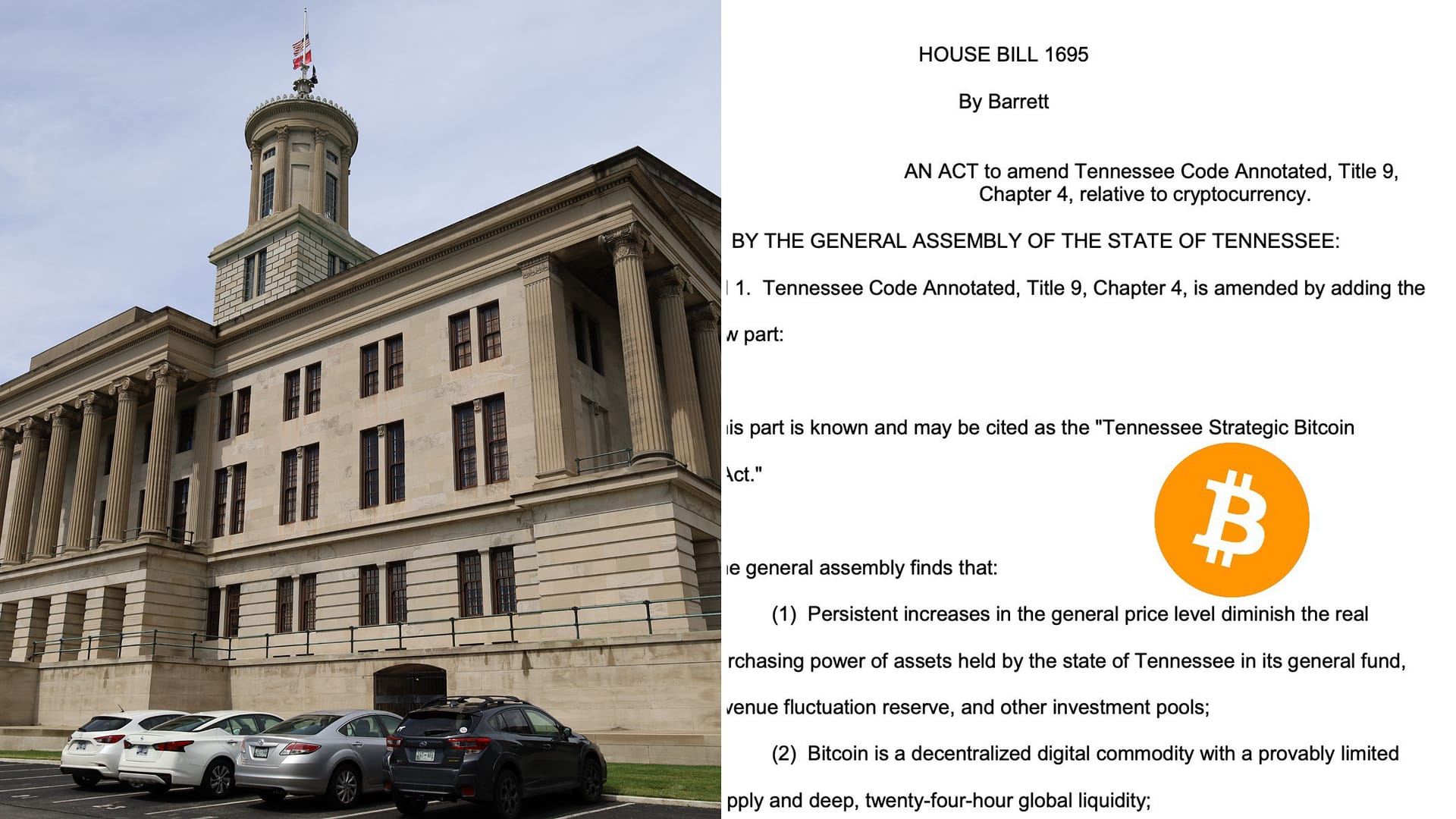

A Tennessee state lawmaker has introduced legislation proposing the creation of a “Tennessee Strategic Bitcoin Reserve,” signaling growing interest among U.S. states in formally integrating digital assets into public finance and long-term reserve strategies.

The proposal reflects a broader national debate over whether Bitcoin can play a role alongside traditional reserve assets amid inflation concerns and evolving monetary frameworks.

Key Takeaways

- Tennessee lawmakers are considering a Strategic Bitcoin Reserve.

- The bill was introduced by State Rep. Jody Barrett.

- The proposal would allow state-level exposure to Bitcoin.

- U.S. states are increasingly exploring crypto-related legislation.

Details of the Proposed Bitcoin Reserve

The bill was introduced by and would establish a framework for creating a state-managed Bitcoin reserve. While specific allocation details have not yet been fully outlined, the initiative aims to recognize Bitcoin as a potential strategic asset.

Supporters argue that limited exposure to Bitcoin could help diversify state reserves and hedge against long-term currency debasement.

Growing State-Level Crypto Interest

Tennessee joins a small but growing group of U.S. states exploring legislation tied to digital assets. Lawmakers in several jurisdictions have proposed measures ranging from accepting crypto payments to investing public funds in blockchain-related instruments.

According to coverage by, these initiatives reflect increasing political engagement with Bitcoin as it gains mainstream recognition.

Supporters and Critics Weigh In

Proponents of the bill view Bitcoin as a long-term store of value with asymmetric upside, particularly in a global environment marked by rising debt levels and monetary uncertainty. They argue that early adoption at the state level could provide strategic advantages.

Critics, however, caution that Bitcoin’s price volatility poses risks to public funds and emphasize the need for strict safeguards, transparency, and clear risk management policies.

Regulatory and Political Implications

If advanced, the proposal could set a precedent for other states considering similar strategies. It may also draw attention from federal regulators monitoring how public entities engage with digital assets.

Observers note that while passage is uncertain, the bill itself underscores how Bitcoin is increasingly part of formal policy discussions rather than a fringe financial instrument.

What To Watch Next

- Committee reviews and debate on the Tennessee bill.

- Clarification on funding sources and reserve management rules.

- Similar Bitcoin reserve proposals from other U.S. states.

This article is for informational purposes only and does not constitute financial advice.