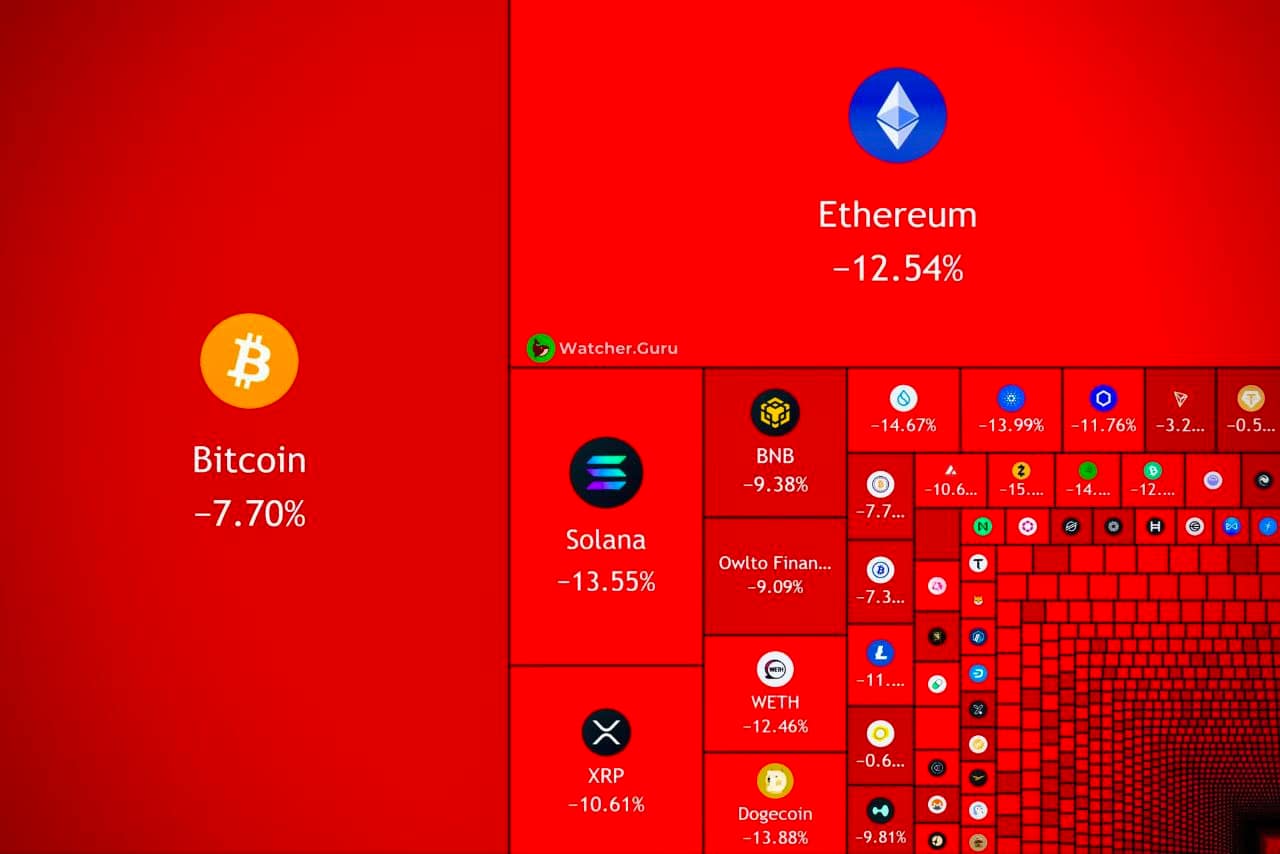

BREAKING NEWS: Bitcoin Slides Below $76,000 as Market Sentiment Weakens

Bitcoin dropped below the $76,000 level, marking a renewed bout of volatility as traders reacted to broader market pressure and shifting risk sentiment across global financial markets. The move represents a notable pullback from recent highs and has raised questions about near-term momentum for the world’s largest cryptocurrency. Key Takeaways Bitcoin fell under the $76,000 … Read more