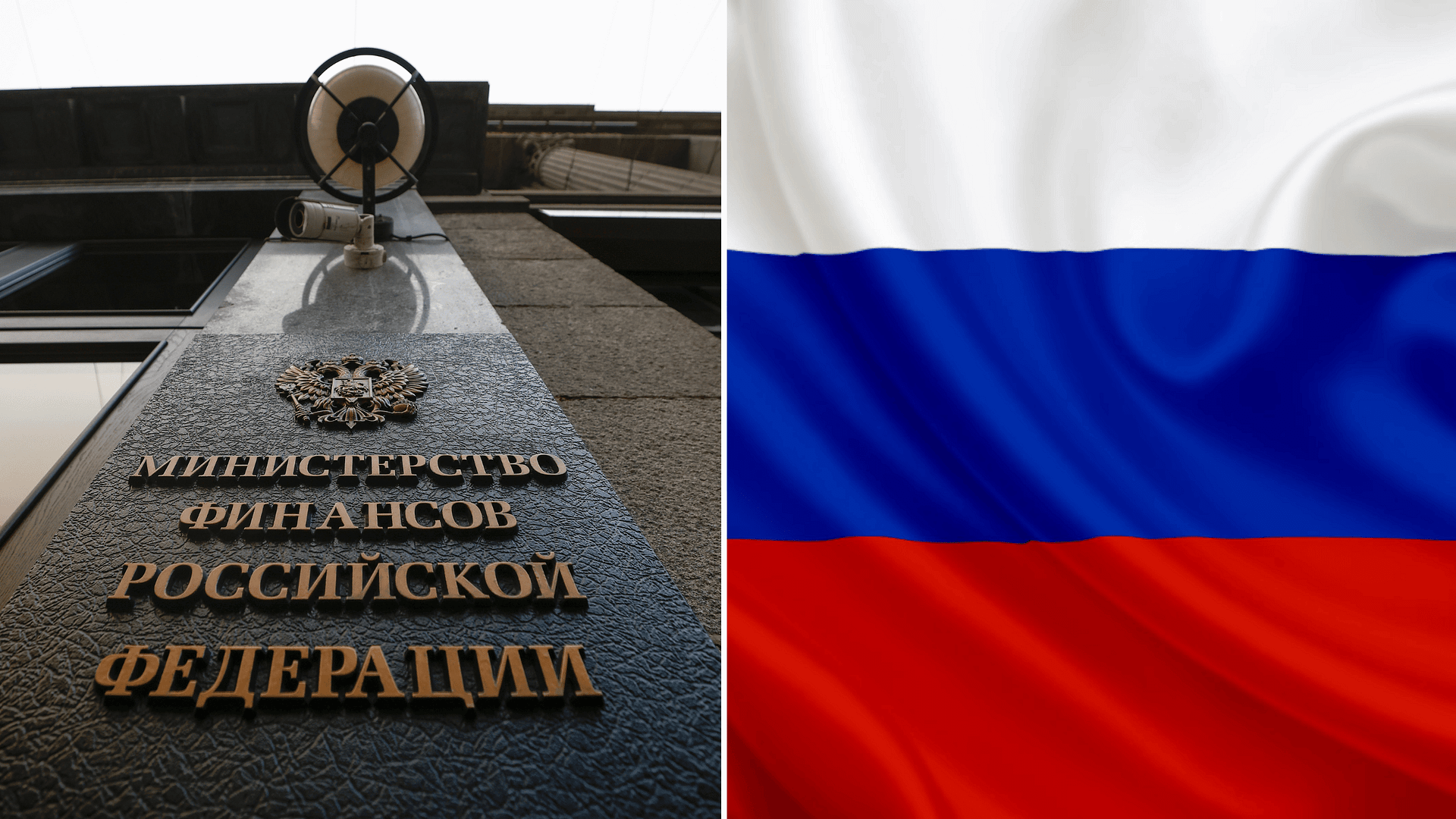

The Russian Ministry of Finance, together with federal authorities and the Central Bank, has released a policy document outlining a national framework for the tokenization of real sector assets, signaling a coordinated push to integrate digital technologies into the country’s traditional economy.

The document, titled “Concept for Tokenization of Real Sector Assets of the Russian Federation,” has been approved by the government and sets out strategic goals for expanding access to capital and improving asset liquidity.

Key Takeaways

- Russia has approved a national concept for tokenizing real sector assets.

- The initiative is backed by the Ministry of Finance, federal authorities, and the Central Bank.

- Tokenization aims to increase liquidity and attract small investors.

- The framework also targets foreign investment and secured lending growth.

Goals of the Tokenization Concept

The newly released concept focuses on using digital tokens to represent real economy assets such as industrial resources, infrastructure, and other tangible holdings. By digitizing these assets, authorities aim to make them more attractive to investors and easier to trade within regulated frameworks.

According to reporting by Reuters, Russian officials see tokenization as a way to modernize capital markets while maintaining state oversight of financial infrastructure.

Improving Liquidity and Access

A central objective of the initiative is to lower barriers to entry for smaller investors. Tokenized assets can be divided into smaller units, enabling broader participation and potentially increasing market liquidity for assets that are traditionally illiquid.

Bloomberg has noted that similar initiatives globally have focused on fractional ownership as a tool to unlock capital and diversify investor bases.

Impact on Credit and Investment

Russian authorities believe that tokenization could strengthen secured credit portfolios by improving transparency and valuation of collateralized assets. The framework also highlights the potential to attract foreign investment by offering digital access to real sector assets under a government-approved structure.

Officials have emphasized that regulatory clarity will be essential to ensure trust and adoption, particularly among institutional and international investors.

Next Steps for Implementation

While the concept outlines strategic direction, further legislative and technical work will be required before large-scale implementation. This includes defining eligible asset classes, custody standards, and compliance requirements.

Analysts caution that geopolitical factors and sanctions-related considerations may influence the pace and scope of foreign participation.

What To Watch Next

- Follow-up legislation or pilot programs linked to asset tokenization.

- Details on which real sector assets will be prioritized.

- Responses from domestic and foreign investors to the framework.

This article is for informational purposes only and does not constitute financial advice.