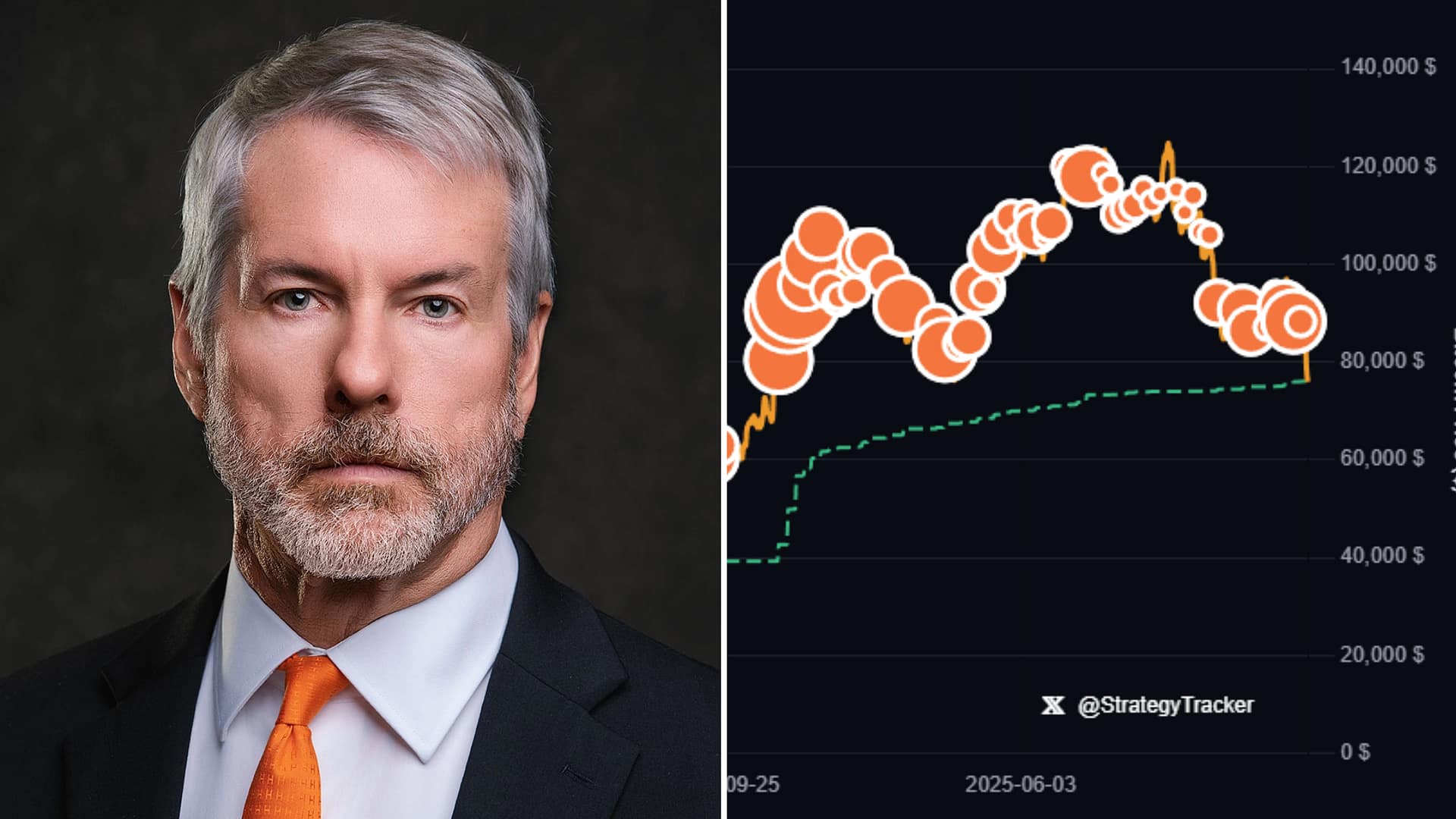

Michael Saylor has once again fueled speculation about an impending Bitcoin purchase after reposting the well-known “Saylor Bitcoin Tracker,” accompanied by the cryptic phrase “More Orange.”

The brief message follows a familiar pattern that market participants have come to associate with fresh Bitcoin accumulation by MicroStrategy, the software firm that holds the largest corporate BTC treasury.

Key Takeaways

- Michael Saylor reposted the Saylor Bitcoin Tracker with the phrase “More Orange.”

- Similar posts have historically preceded Bitcoin purchases.

- MicroStrategy remains the largest corporate holder of BTC.

- Investors are watching for an official filing or announcement.

A Familiar Signal to Bitcoin Markets

Saylor’s posts featuring the Bitcoin tracker have repeatedly come just days before MicroStrategy disclosed new BTC acquisitions. According to Bloomberg, the company has consistently used debt offerings and excess cash to expand its Bitcoin holdings, treating BTC as a long-term treasury reserve asset.

While no purchase has been confirmed, the timing and wording of the post immediately sparked speculation across crypto markets.

MicroStrategy’s Bitcoin Strategy

MicroStrategy, under Saylor’s leadership, has accumulated hundreds of thousands of bitcoins over several years. Reuters has reported that the firm views Bitcoin as a hedge against inflation and currency debasement, a stance that has made it a proxy investment for institutional Bitcoin exposure.

Saylor has repeatedly emphasized that the company’s strategy is focused on long-term accumulation rather than short-term price movements.

Market Reaction and Expectations

Traders and analysts often monitor Saylor’s social media activity as an informal signal of upcoming disclosures. The Wall Street Journal has previously noted that MicroStrategy typically announces purchases through regulatory filings or press releases shortly after similar online hints.

Any confirmed purchase could add incremental demand at a time when Bitcoin supply dynamics remain a key narrative for the market.

Broader Corporate Bitcoin Trend

MicroStrategy’s continued accumulation stands in contrast to many corporations that remain cautious about Bitcoin exposure. Reuters has documented how accounting rules, volatility, and regulatory uncertainty still deter widespread corporate adoption.

Nevertheless, Saylor’s actions continue to influence sentiment around Bitcoin’s role in corporate treasuries.

What To Watch Next

- Official confirmation of a new Bitcoin purchase by MicroStrategy.

- Regulatory filings detailing BTC holdings changes.

- Market reaction following any formal announcement.

- Renewed discussion around corporate Bitcoin accumulation.

This article is for informational purposes only and does not constitute financial advice.