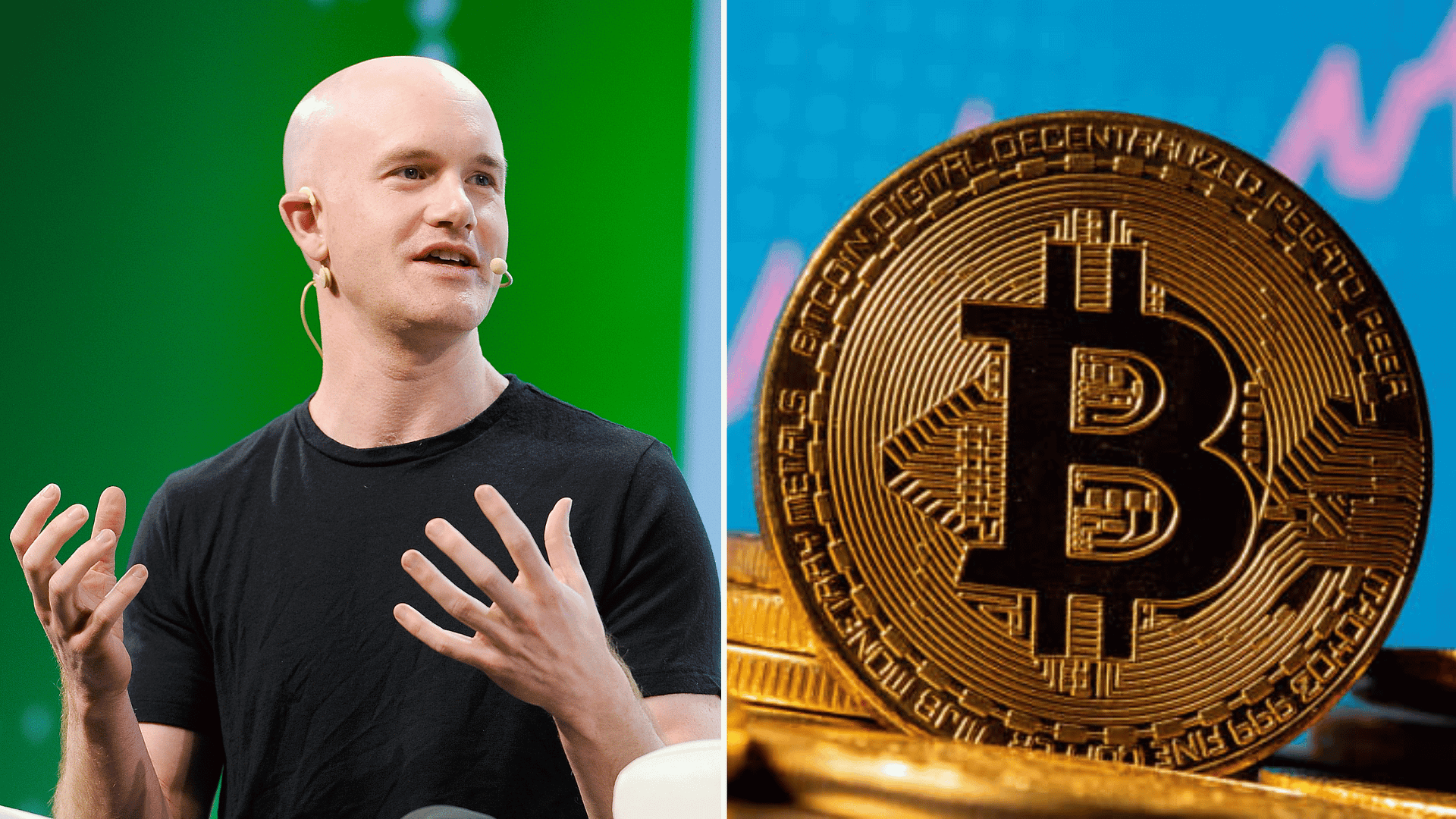

Tensions between Wall Street banks and the crypto industry surfaced publicly after JPMorgan CEO Jamie Dimon sharply rebuked Coinbase CEO Brian Armstrong over accusations that banks are obstructing crypto-friendly legislation in the United States.

The exchange underscores the widening divide between traditional financial institutions and digital asset firms as lawmakers debate the future regulatory framework for cryptocurrencies.

Key Takeaways

- Jamie Dimon rejected claims that banks are blocking crypto legislation.

- Brian Armstrong accused traditional banks of influencing policy against crypto.

- The dispute highlights growing friction between banks and digital asset firms.

- Crypto regulation remains a contentious issue in Washington.

Heated Exchange Between Industry Leaders

According to reporting by, told that his accusations were unfounded after Armstrong suggested that major banks were working behind the scenes to block crypto-friendly legislation.

The blunt response illustrates how personal and high-stakes the regulatory debate has become as both sides seek to shape policy outcomes.

Banks and Crypto Firms at Odds

Armstrong has been vocal in arguing that established financial institutions view crypto as a competitive threat and therefore oppose legislation that could legitimize and expand the sector. Large banks, by contrast, have consistently said their concerns center on consumer protection, financial stability, and compliance risks.

has previously expressed skepticism about certain crypto activities while still exploring blockchain-based technologies internally.

Regulatory Debate Intensifies in Washington

The clash comes as U.S. lawmakers consider multiple bills aimed at defining oversight of digital assets, including the respective roles of securities and commodities regulators. Lobbying from both the banking sector and crypto companies has intensified as the stakes for market structure and compliance costs grow.

Coverage by has noted that disagreements between incumbents and disruptors are complicating efforts to reach bipartisan consensus.

Implications for Crypto Policy

Public disputes between prominent executives may further polarize the debate, potentially slowing progress on comprehensive legislation. At the same time, they draw attention to the competing interests shaping U.S. financial regulation.

Observers say the outcome will influence not only crypto firms like but also how traditional banks participate in digital asset markets.

What To Watch Next

- Advancement of crypto-related bills in Congress.

- Lobbying activity from banks and digital asset firms.

- Further public commentary from industry leaders on regulation.

This article is for informational purposes only and does not constitute financial advice.