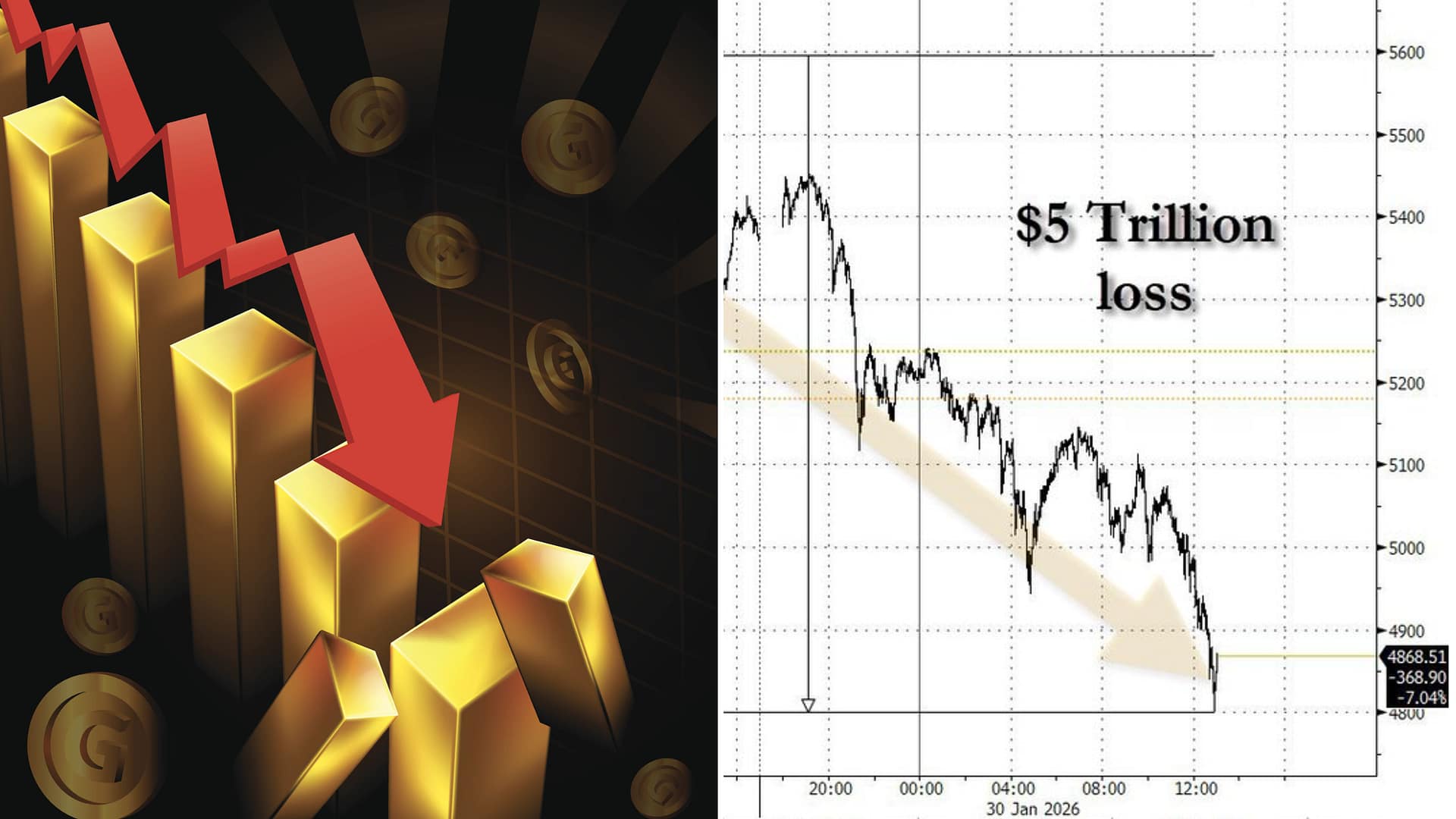

The global gold market shed more than $5 trillion in value within a 48-hour period, marking one of the sharpest short-term contractions in the precious metal’s market capitalization on record. The scale of the move has drawn attention across financial markets, particularly when compared with the much smaller size of the cryptocurrency sector.

The decline highlights how even the world’s most established safe-haven assets can experience extreme volatility during periods of rapid repricing.

Key Takeaways

- Gold lost over $5 trillion in market value in roughly two days.

- The drop is nearly three times larger than Bitcoin’s total market capitalization.

- Precious metals saw heavy selling amid shifting macro expectations.

- The move underscores the scale and sensitivity of traditional asset markets.

Scale of the Gold Market Sell-Off

Gold’s massive market capitalization means even relatively modest percentage moves can translate into trillions of dollars in value gained or lost. According to market estimates cited by, the recent decline reflected a rapid repricing driven by futures markets and institutional positioning.

The sell-off unfolded quickly as traders adjusted exposure across commodities in response to changing macro signals.

Comparison With Bitcoin Highlights Market Size Gap

The roughly $5 trillion contraction is almost three times the total market capitalization of Bitcoin, illustrating the vast difference in scale between traditional asset classes and digital assets. While cryptocurrencies often appear volatile in percentage terms, the absolute value swings in legacy markets can be far larger.

Analysts noted that such comparisons help contextualize risk and liquidity dynamics across asset classes.

Macro Forces Behind the Move

Rising real yields, currency movements, and expectations around monetary policy have weighed on gold prices. Coverage by pointed to aggressive repositioning by large funds as key technical levels were breached.

These forces tend to impact gold disproportionately due to its role as a non-yielding asset.

Implications for Investors

The episode serves as a reminder that size and longevity do not eliminate volatility. Large, deeply liquid markets can still experience abrupt value shifts when sentiment changes quickly.

For investors, the contrast between gold and Bitcoin also underscores differing risk profiles, adoption stages, and market structures.

What To Watch Next

- Stabilization or further declines in gold prices.

- Movements in real interest rates and the U.S. dollar.

- Relative performance between traditional assets and digital markets.

This article is for informational purposes only and does not constitute financial advice.