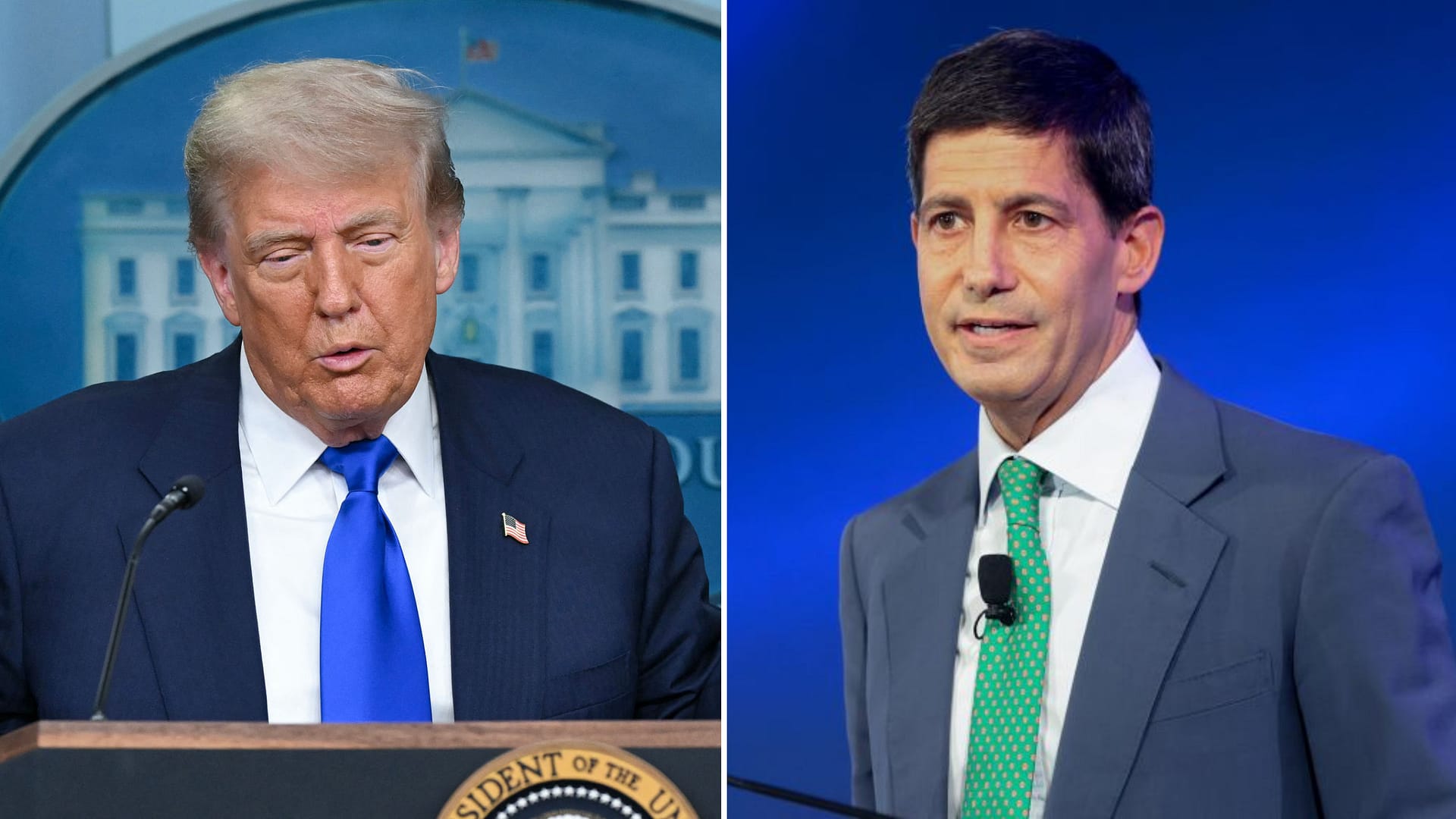

Trump Says Kevin Warsh Would Cut Rates Independently if Named Fed Chair

Former U.S. President Donald Trump said that Kevin Warsh would cut interest rates without any external pressure, should he take on the role of Federal Reserve chair, framing the potential policy shift as an independent decision rather than a politically driven move. The comments have drawn attention as markets remain highly sensitive to signals around … Read more