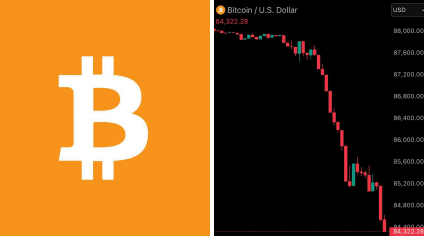

Bitcoin dropped below the $85,000 level amid a sharp market-wide sell-off, triggering roughly $430 million in liquidations across the crypto market within a single hour. The sudden move underscores ongoing volatility as leveraged positions were rapidly unwound.

The decline occurred during a brief but intense wave of selling pressure, impacting both Bitcoin and major altcoins as traders rushed to close positions.

Key Takeaways

- Bitcoin fell under $85,000 during a rapid market downturn.

- About $430 million in crypto positions were liquidated in 60 minutes.

- Long positions accounted for the majority of liquidations.

- The move highlights elevated leverage and short-term volatility.

Liquidations Accelerate During Sudden Price Drop

Data from derivatives tracking platforms shows that the bulk of the $430 million in liquidations came from long positions, as traders betting on higher prices were forced out. Market data aggregators widely cited by exchanges indicated that Bitcoin accounted for a significant share of the losses, with Ethereum and other large-cap tokens also affected.

According to figures referenced by platforms monitoring futures markets, the speed of the move amplified forced selling as stop-losses and margin calls cascaded.

Broader Market Impact

The sharp decline briefly pushed total crypto market capitalization lower, with risk sentiment weakening across digital assets. Pricing data from major spot exchanges showed synchronized drops, suggesting a broad-based reaction rather than isolated selling.

Leverage Remains a Key Risk Factor

Analysts have repeatedly warned that elevated leverage leaves the market vulnerable to abrupt corrections. In previous market updates, derivatives researchers noted that even modest price moves can trigger outsized liquidations when open interest is heavily skewed toward one side.

Macro and Sentiment Pressures

The sell-off comes amid continued uncertainty around macroeconomic conditions and near-term monetary policy expectations. Recent market commentary from institutional research desks has pointed to heightened sensitivity to sudden shifts in risk appetite, particularly in highly leveraged assets such as cryptocurrencies.

What To Watch Next

- Whether Bitcoin can reclaim and hold above the $85,000 level.

- Changes in open interest and funding rates following the flush-out.

- Spillover effects on altcoins and broader market sentiment.

- Any macro or news catalysts that could drive further volatility.

This article is for informational purposes only and does not constitute financial advice.