Crypto gives you full control.

No bank can freeze it. No platform can reset your access. No one can override your private keys.

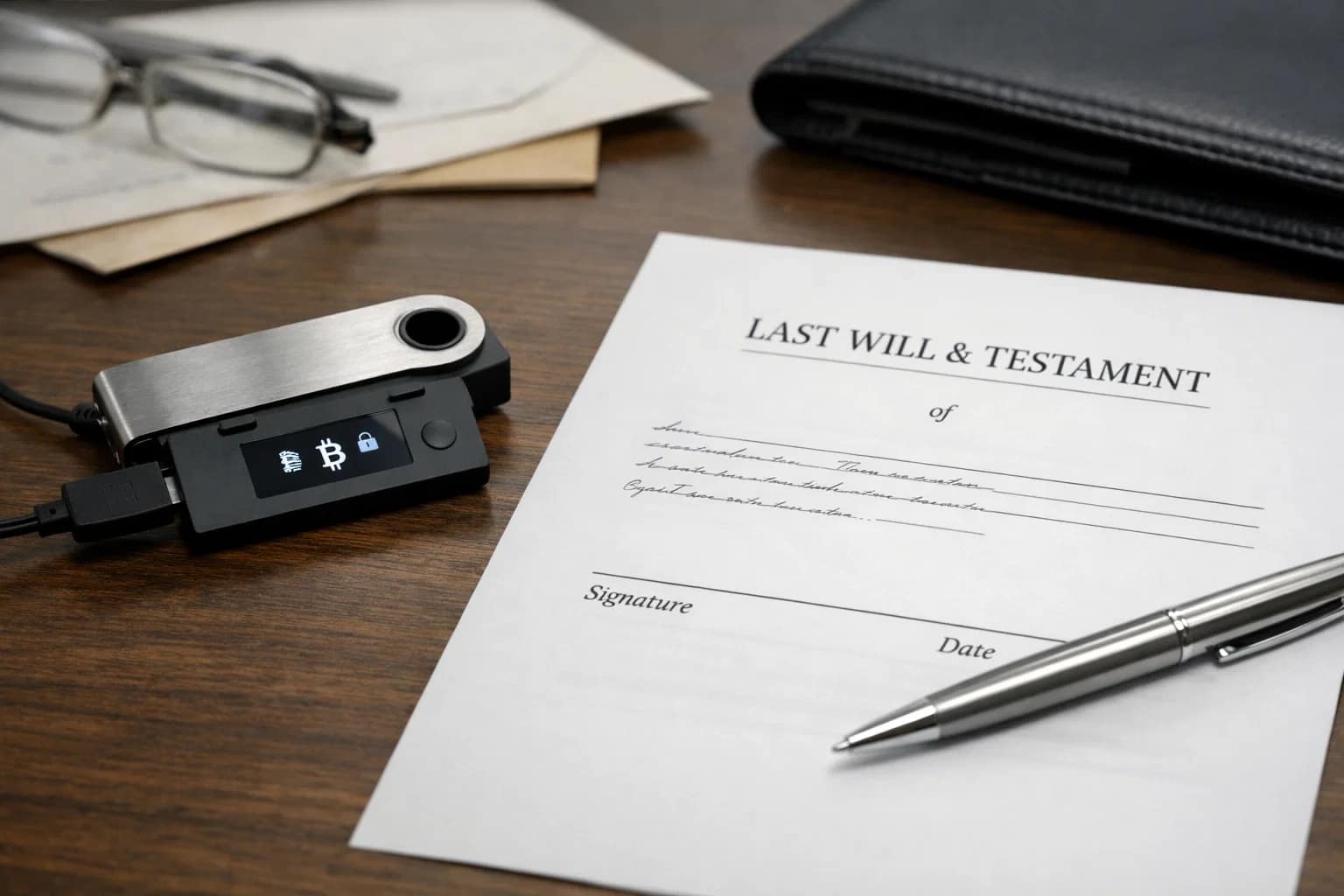

That independence is powerful, until inheritance enters the picture.

When you die, your crypto doesn’t automatically move to your family. There’s no recovery department stepping in to unlock a wallet. If access isn’t documented properly, those assets can remain on the blockchain forever — visible, but unreachable.

This raises an uncomfortable question most investors avoid:

What actually happens to your crypto when you’re no longer here?

Where Does Your Crypto Go When You Pass Away?

Short answer: nowhere.

Your wallet doesn’t close, liquidate, or notify anyone. It just stays there on the blockchain, inaccessible without the keys. If no one has them, the assets are functionally gone.

This isn’t rare. Blockchain analysts estimate that more than $100 billion in crypto is already considered lost, not from hacks, but from missing access.

If your funds are held on an exchange, the process isn’t much easier. Once an exchange is notified of a death, accounts are frozen. Heirs must provide death certificates, court documents, executor credentials, and wait through probate before access is granted, which often takes months.

For active traders and long-term holders alike, that delay matters.

Practical Ways to Plan Ahead

🔏 Solution 1: Multi-Signature Wallets

One way people plan around this is by using multi-signature wallets. Instead of one private key controlling everything, access is split across several keys.

A common setup looks like this:

You control one key.

A trusted family member controls another.

A lawyer or custody service holds the third.

To move funds, two of the three must approve the transaction. That structure removes the single point of failure without giving full control to anyone else.

If something happens to you, the remaining parties can still access the funds together, without guessing passwords or relying on an exchange’s internal process.

The trade-off here is responsibility. Setup matters, and here is the best way to set up your crypto wallet without getting hacked, because poor configuration defeats the purpose.

🧨 Solution 2: Dead Man’s Switch Services

Another approach is what’s often called a dead man’s switch.

Dead man’s switch services require regular check-ins: logins, confirmations, or some form of digital signal.

If you stop checking in for a set period (often 6–12 months), encrypted access details are automatically released to pre-selected beneficiaries.

Some setups combine this with cold storage or multi-signature wallets, adding another layer of protection without giving up control too early.

It isn’t perfect. No system is, but it reduces the risk of total loss if something unexpected happens.

🪪 Solution 3: Paper Still Matters

Tech isn’t enough.

Your will or trust should mention that you own crypto, what kind of wallets you use, and where devices are kept —

without ever listing private keys.

Seed phrases don’t belong in a will. That’s like putting your bank PIN in a public file.

Store sensitive details securely and reference their location in your legal documents instead.

A short letter of instruction can also help heirs understand what to do, without exposing anything dangerous.

Crypto is digital, inheritance isn’t.

📊 Solution 4: Exchange Account Planning

Exchanges don’t work like banks. You can’t simply name a beneficiary and move on. Once a death is reported, the account is frozen. Access is only restored after legal verification, and even with the right documents, heirs may wait months.

If you keep funds on an exchange, list the account (not the password) in your will. Appoint an executor who understands crypto. And assume there will be delays.

Planning won’t make the process fast. It will just make it possible.

🚨 What About Taxes?

In many countries, inherited crypto gets what’s called a “step-up” in cost basis.

That simply means your heirs receive the assets at their market value on the date of inheritance. The gains you accumulated during your lifetime usually aren’t taxed at that moment.

Taxes typically come into play only if the assets are later sold, and they’re calculated from that new starting value.

Rules vary depending on where you live, so this is one area where professional advice actually matters.

📌 Final Thoughts

Crypto gives you total control. That includes what happens when you’re no longer here. Without planning, assets can remain permanently inaccessible. For traders, this is risk management, not estate planning.