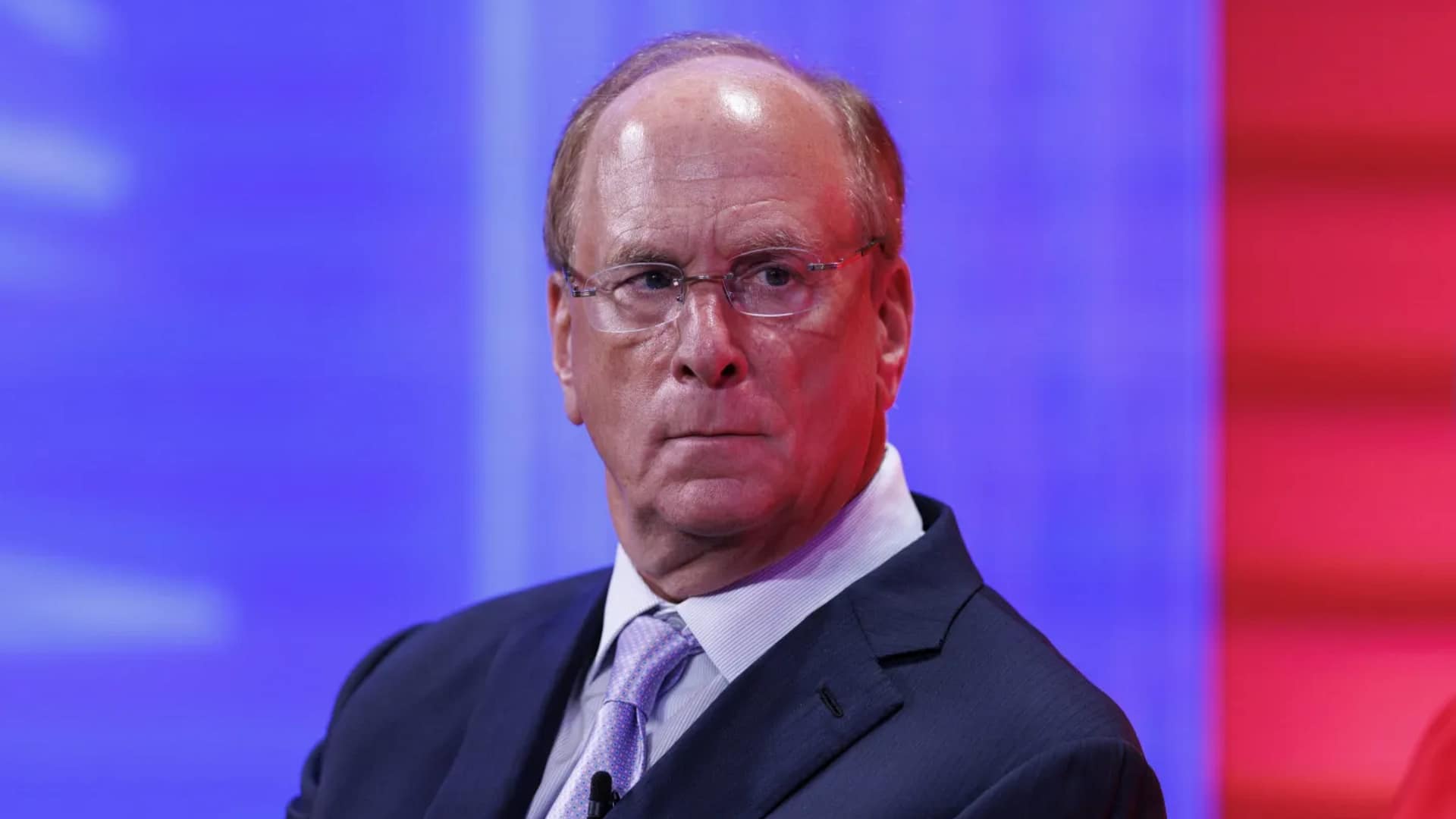

BlackRock CEO Larry Fink has cautioned that rising U.S. debt obligations could pose long-term risks to the dollar’s dominance, warning that uncontrolled debt payments may erode confidence in the world’s reserve currency. His remarks come amid growing concerns over the trajectory of U.S. fiscal deficits and interest costs.

Fink suggested that if debt servicing costs continue to expand rapidly, the structural stability underpinning the U.S. dollar could weaken, potentially reshaping global financial markets.

Key Takeaways

- Larry Fink warned that unchecked U.S. debt payments could threaten dollar stability.

- Rising interest costs are increasing pressure on federal finances.

- The dollar’s reserve currency status depends on long-term fiscal credibility.

- Markets are closely monitoring U.S. debt sustainability trends.

Growing Concern Over Debt Servicing Costs

The United States has seen a steady increase in federal debt levels over the past decade, with higher interest rates amplifying borrowing costs. As Treasury yields remain elevated, the cost of servicing existing debt has grown, drawing attention from investors and policymakers.

Fink emphasized that if debt payments crowd out other fiscal priorities, global confidence in U.S. financial leadership could gradually erode.

Implications for the US Dollar

The U.S. dollar remains the world’s primary reserve currency, widely used in trade, commodities pricing, and cross-border finance. However, its position relies on deep capital markets, institutional stability, and trust in fiscal management.

Fink’s comments highlight the risk that sustained fiscal imbalance could weaken that trust over time, especially if debt growth significantly outpaces economic expansion.

Market and Investor Reactions

While no immediate shift away from the dollar appears underway, analysts note that long-term structural concerns are increasingly part of global macro discussions. Large institutional investors, including asset managers and sovereign funds, continue to assess currency exposure and diversification strategies.

Previous annual letters from Fink have addressed fiscal sustainability and the broader impact of macroeconomic policy on global capital flows.

Broader Macro Context

Rising geopolitical tensions, inflation cycles, and tighter monetary conditions have intensified scrutiny on sovereign debt levels worldwide. In the U.S., fiscal deficits and entitlement spending projections are frequently cited as key long-term challenges.

Economists generally agree that maintaining the dollar’s dominance requires credible fiscal frameworks and stable monetary policy.

What To Watch Next

- Future U.S. Treasury issuance and interest expense trends.

- Federal Reserve policy decisions affecting borrowing costs.

- Statements from major asset managers and global central banks.

This article is for informational purposes only and does not constitute financial advice.