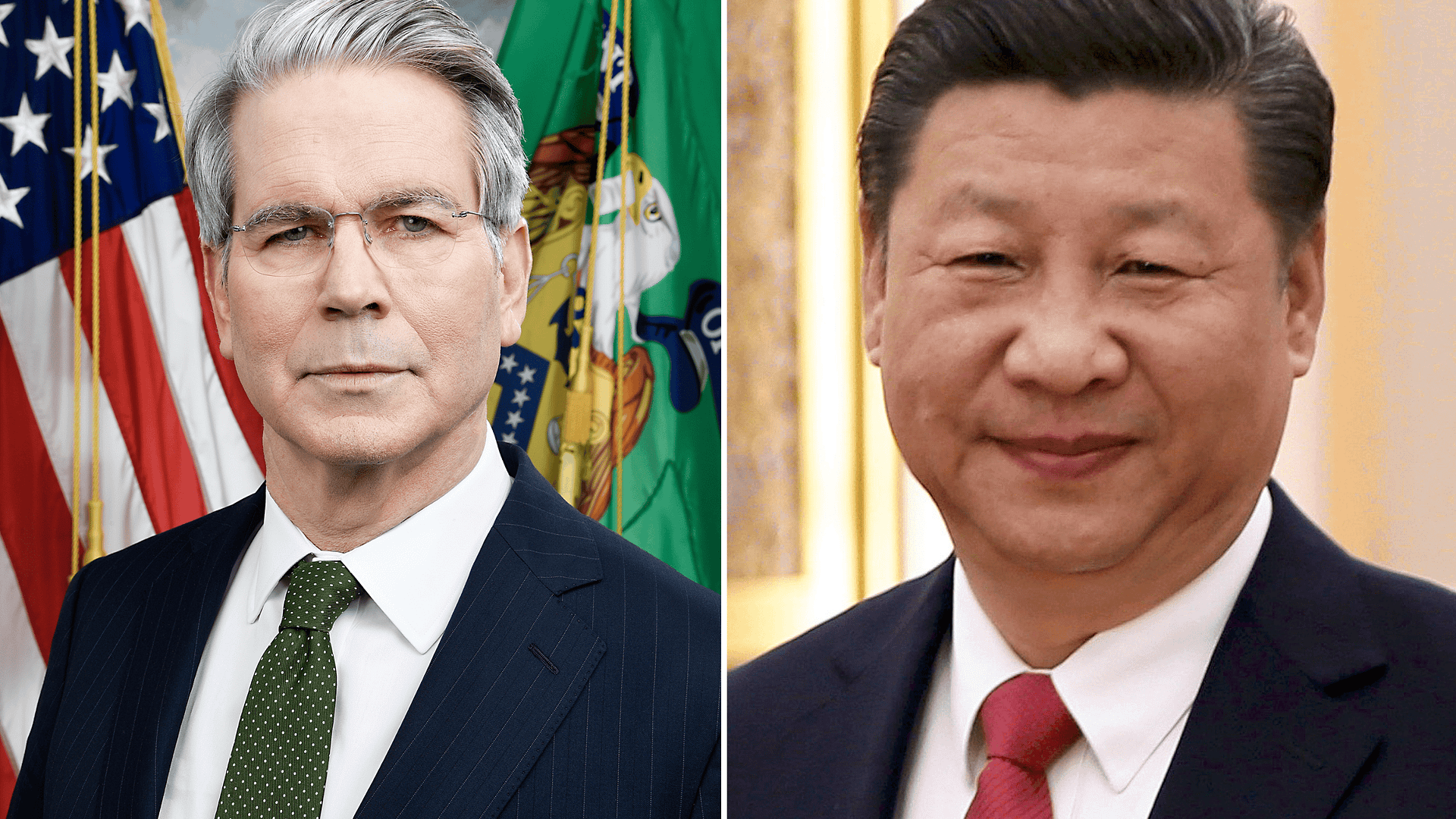

U.S. Treasury Secretary Scott Bessent said there are rumors suggesting that China is developing digital assets that would not be backed by the yuan, raising new questions about Beijing’s long-term strategy in digital finance.

The comments come amid intensifying global competition over digital currencies, payment infrastructure, and the future architecture of international finance.

Key Takeaways

- Treasury Secretary Bessent cited rumors of China developing digital assets not tied to the yuan.

- No official confirmation has been provided by Chinese authorities.

- The remarks highlight growing geopolitical competition in digital finance.

- Digital assets are increasingly viewed as strategic economic tools.

Bessent’s Remarks on China

Speaking publicly, Bessent emphasized that the information remains unconfirmed, describing it as market and policy rumors rather than verified intelligence. He noted that any move by China to explore non-yuan-backed digital assets would represent a significant departure from its current tightly controlled monetary framework.

Reuters has previously reported that China maintains strict oversight of digital currencies, while simultaneously advancing its central bank digital currency, the digital yuan.

China’s Existing Digital Currency Strategy

China has long positioned the digital yuan as a state-controlled alternative to private cryptocurrencies, banning crypto trading and mining while promoting its central bank digital currency domestically. The digital yuan is widely viewed as a tool to strengthen monetary control and modernize payment systems.

Bloomberg has noted that Chinese policymakers have consistently opposed decentralized digital assets that operate outside state supervision.

Why Non-Yuan Digital Assets Matter

If China were to support or experiment with digital assets not backed by the yuan, it could signal a strategic shift aimed at cross-border settlements, trade finance, or geopolitical influence. Such assets could potentially be designed for international use without directly exposing the yuan to foreign market pressures.

Analysts caution, however, that rumors alone are insufficient to suggest a policy reversal, given China’s historical stance on capital controls.

What To Watch Next

- Official responses or clarifications from Chinese financial authorities.

- Further comments from U.S. Treasury officials on digital asset policy.

- Developments in global central bank digital currency initiatives.

This article is for informational purposes only and does not constitute financial advice.

Read Also: Top Chinese, U.S. Officials Meet in Sweden for Second Day of Tense Tariff Talks