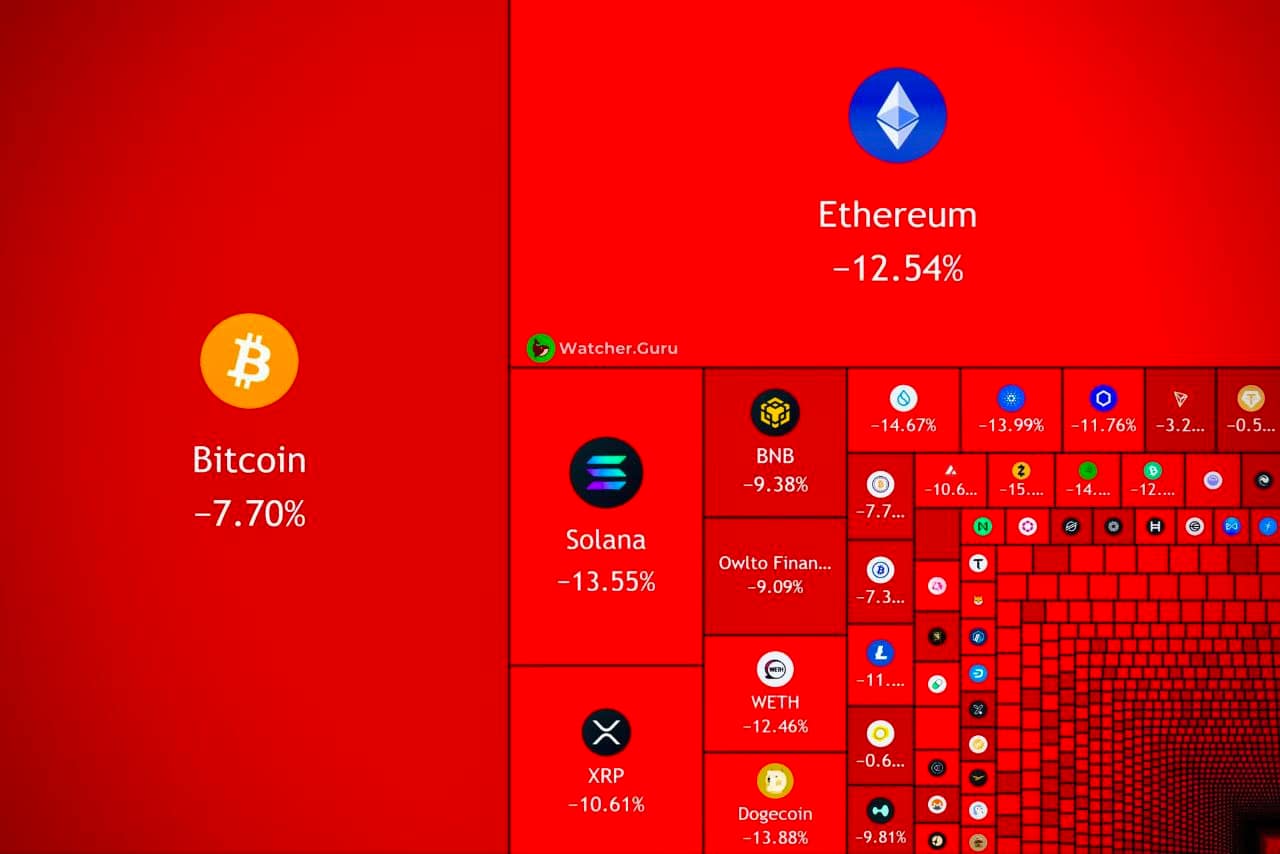

Roughly $230 billion in value was erased from the total cryptocurrency market over the past 24 hours as broad-based selling pressured major tokens and higher-beta altcoins. The pullback reflects a familiar mix of spot selling and leverage unwinds after a volatile stretch for risk assets.

Market trackers showed the total crypto capitalization sliding sharply during the session, with CoinMarketCap’s aggregate market data highlighting the scale of the move, while CoinGlass liquidation dashboards pointed to elevated forced closures in derivatives as prices fell.

Key Takeaways

- About $230B was wiped from total crypto market capitalization over roughly a day of trading.

- Bitcoin and Ethereum led the downturn, with deeper drawdowns across higher-volatility altcoins.

- Derivatives liquidations accelerated losses as leverage was reduced across major venues.

- Sentiment gauges weakened, with “fear” readings returning in widely followed market mood indices.

- Macro sensitivity remains high as traders react to rates expectations and equity-market momentum.

Broad Selling Pressures Majors and Altcoins

The day’s decline was not isolated to a single sector. Large-cap assets typically used as bellwethers—Bitcoin and Ethereum—moved lower alongside a wide basket of altcoins, suggesting a risk-off rotation rather than a token-specific shock.

Aggregated market-cap tracking from CoinMarketCap showed the drawdown occurring over a concentrated window, a pattern commonly seen when liquidity thins and correlated selling takes hold across exchanges.

Liquidations Add Fuel to the Downturn

As prices fell, derivatives positioning became a major accelerant. CoinGlass data indicated a rise in forced liquidations, a dynamic that can create a feedback loop: liquidations push price lower, triggering more stop-outs and margin calls.

When leverage is elevated, even modest spot moves can cascade through perpetual swaps and futures books, amplifying intraday volatility and widening short-term swings.

Sentiment Slips Back Toward “Fear”

Investor mood also deteriorated alongside the price action. The Crypto Fear & Greed Index, a widely referenced sentiment gauge published by Alternative.me, weakened during the sell-off and signaled a shift away from complacency.

In prior episodes of sharp market-cap compression, falling sentiment readings have tended to coincide with reduced risk appetite, lower bid depth, and choppier rebounds.

Macro Backdrop Keeps Crypto Tied to Risk Assets

Crypto’s correlation with broader markets has remained a key theme, especially during abrupt drawdowns. Traders often watch rate expectations, the U.S. dollar, and equity volatility as inputs into crypto positioning, particularly when ETF flows and institutional activity are subdued.

In recent market commentary, analysts have repeatedly pointed to macro catalysts—such as shifting expectations for central-bank policy and changes in risk appetite—as drivers that can outweigh crypto-specific narratives on short timeframes.

What To Watch Next

- Whether liquidation pressure fades, allowing spot demand to reassert itself.

- Stability in Bitcoin dominance and whether capital rotates back into large caps first.

- Updates in ETF flow data and signs of renewed institutional dip-buying.