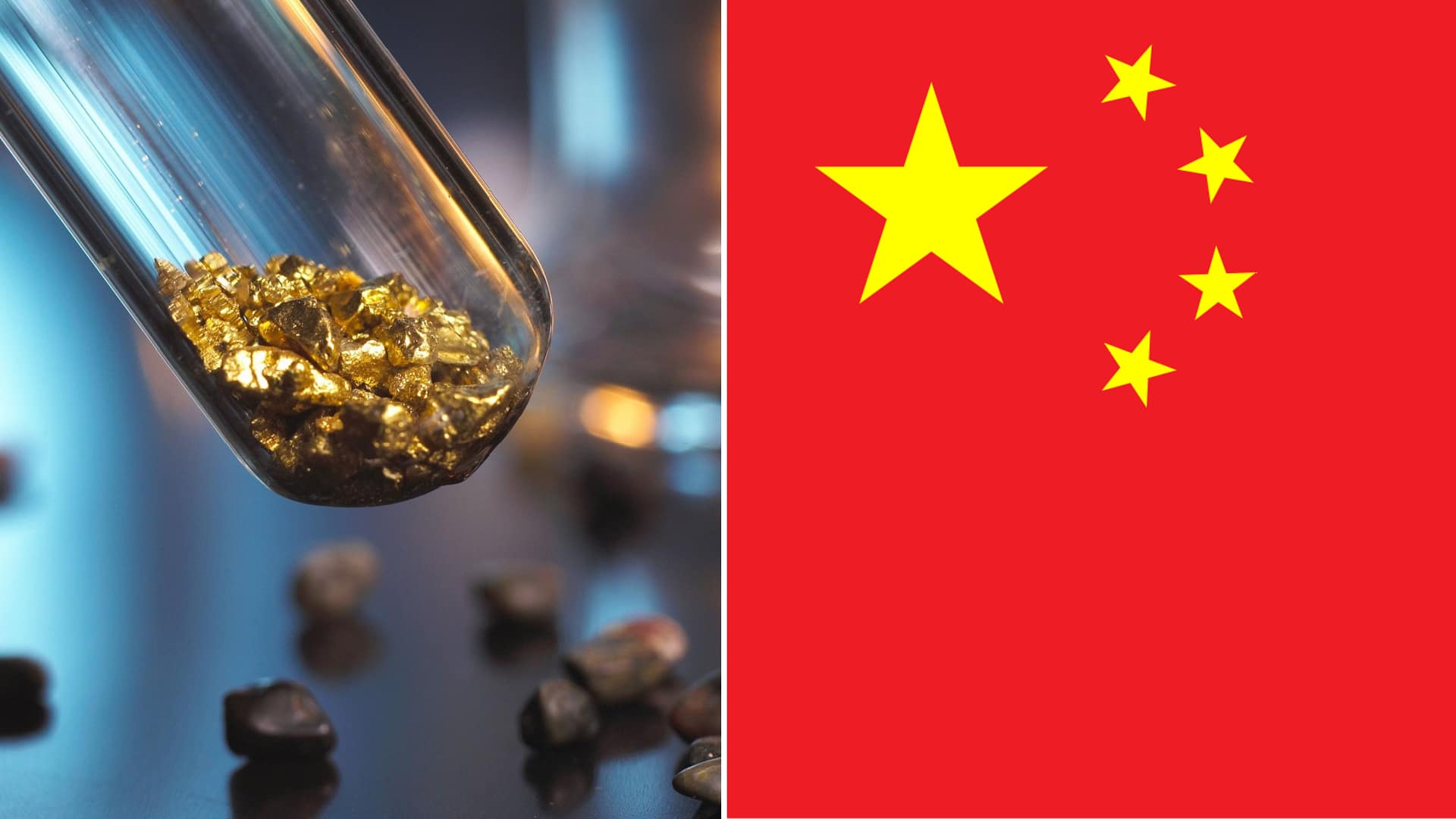

Unverified reports claiming that Chinese laboratories have produced synthetic gold and silver are circulating widely, adding a new layer of uncertainty to already volatile precious metals markets. While no official confirmation has been provided, the speculation alone has fueled concerns about potential long-term impacts on gold and silver valuations.

Market participants warn that if such claims were ever substantiated at scale, they could fundamentally alter supply dynamics for precious metals.

Key Takeaways

- Unconfirmed claims suggest synthetic gold and silver production in China.

- No official verification has been issued by authorities or regulators.

- Speculation has added to recent pressure on gold and silver prices.

- Analysts caution against drawing conclusions without evidence.

Unverified Claims Spark Market Debate

The reports, which have spread primarily through online channels and market commentary, suggest that Chinese researchers may have found a way to synthetically produce gold and silver. However, there has been no confirmation from Chinese authorities, academic institutions, or major industry bodies.

Commentary referenced by international financial media has stressed that extraordinary claims require transparent verification and peer-reviewed validation before being considered credible.

Why Synthetic Metals Would Matter

Gold and silver derive much of their value from scarcity and the high cost of extraction. If synthetic production were proven viable and scalable, it could challenge the fundamental supply assumptions underpinning precious metals markets.

That said, scientists have long noted that while nuclear reactions can theoretically produce gold, the process is prohibitively expensive and impractical for commercial use.

Market Reaction Driven by Sentiment

Recent declines in gold and silver prices have largely been attributed to macroeconomic factors such as interest rates, currency movements, and risk appetite. Analysts cited by global news outlets have cautioned that unverified technological claims can temporarily amplify volatility without altering long-term fundamentals.

In past episodes, similar rumors have tended to fade once scrutiny increases and evidence fails to materialize.

Calls for Caution From Analysts

Market strategists emphasize that investors should distinguish between speculative narratives and confirmed developments. Without independent verification, the reports are viewed as low-confidence information rather than actionable market signals.

Regulators and scientific institutions have so far remained silent, reinforcing the lack of substantiated proof.

What To Watch Next

- Any official statements from Chinese authorities or research institutions.

- Scientific validation or peer-reviewed evidence supporting the claims.

- Whether precious metals prices stabilize as speculation subsides.

This article is for informational purposes only and does not constitute financial advice.