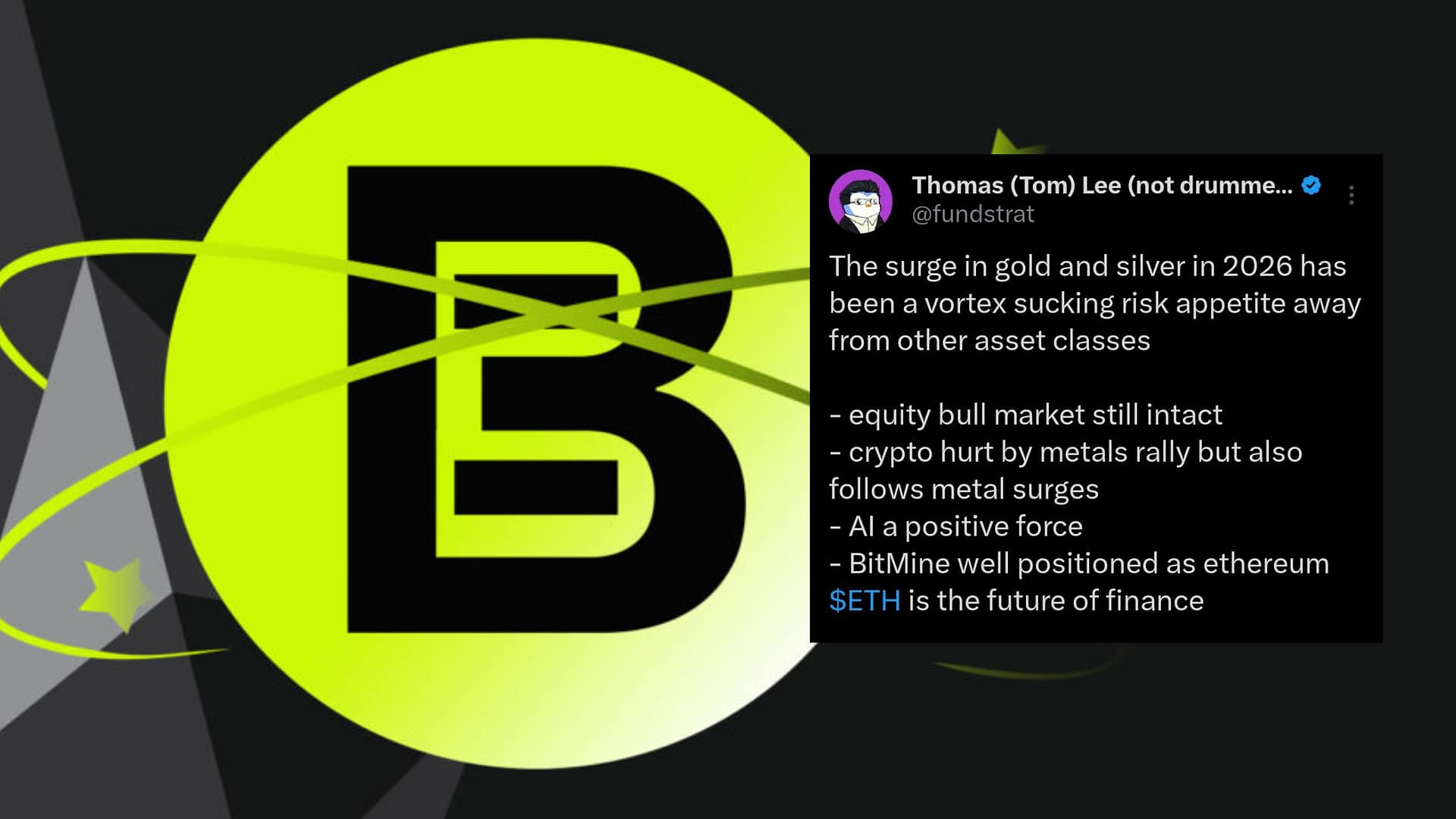

Fundstrat’s Thomas “Tom” Lee said BitMine is “well positioned” as Ethereum increasingly underpins modern financial infrastructure, framing the company’s strategy around long-term ETH accumulation and staking rather than short-term price moves.

Lee’s comments come as investors have piled into gold and silver, a rotation he argues has temporarily pulled risk appetite away from crypto even as broader equity momentum remains intact.

Key Takeaways

- Tom Lee says the metals rally has diverted capital from crypto, but expects crypto to re-engage when metals cool.

- BitMine’s Ethereum-focused treasury strategy is designed to benefit from growing institutional on-chain adoption.

- Corporate ETH accumulation and staking can amplify both opportunity and centralization debates.

- Market attention is splitting between “safe-haven” flows and tech-led narratives like AI and tokenization.

Metals Rally Becomes a Headwind for Crypto Risk Appetite

Lee has argued that the strength in gold and silver has acted like a gravitational pull on capital that might otherwise flow into higher-beta assets such as crypto. Cointelegraph reported that Lee believes Bitcoin and Ethereum can still play “catch-up” once the precious-metals surge cools and investors rotate back toward risk assets.

That framing matters for ETH in particular because it positions underperformance as cyclical positioning rather than a breakdown in fundamentals—an important distinction for allocators watching liquidity conditions and cross-asset correlations.

Why BitMine Is Centering Its Strategy on Ethereum

Lee’s “future of finance” thesis for Ethereum is rooted in the network’s role as settlement infrastructure for tokenized assets, stablecoins, and programmable financial applications. In that context, BitMine’s approach is to build a large ETH treasury and put a meaningful portion to work via staking and validator operations.

Coverage from The Block has described BitMine as expanding its Ether holdings as part of a longer-term accumulation effort, tying the strategy to the idea that Ethereum could capture more institutional activity as on-chain markets mature.

Corporate ETH Treasuries: Staking Yield Meets Governance Questions

Large corporate treasuries can add a new dimension to Ethereum’s market structure: they potentially reduce liquid supply while increasing the amount of ETH committed to staking. At the same time, concentration can raise questions about decentralization and influence.

Yahoo Finance has previously highlighted BitMine’s rapid growth in ETH holdings and the related debate over what large, concentrated corporate positions could mean for Ethereum’s ecosystem over time.

How This Could Shape ETH’s Narrative in 2026

If the metals-led rotation eases, ETH could benefit from a shift back toward tech and growth narratives—especially those tied to tokenization, stablecoin rails, and on-chain settlement. Lee’s view suggests that Ethereum’s investment case may increasingly be judged alongside broader “infrastructure” trends, not just crypto-specific cycles.

For BitMine, the bet is straightforward: if Ethereum’s role in financial plumbing expands, an ETH treasury plus staking operations may provide both strategic exposure and operational leverage to network activity.

Read Also: Top No-KYC Crypto Casinos for Anonymous Gambling in 2025