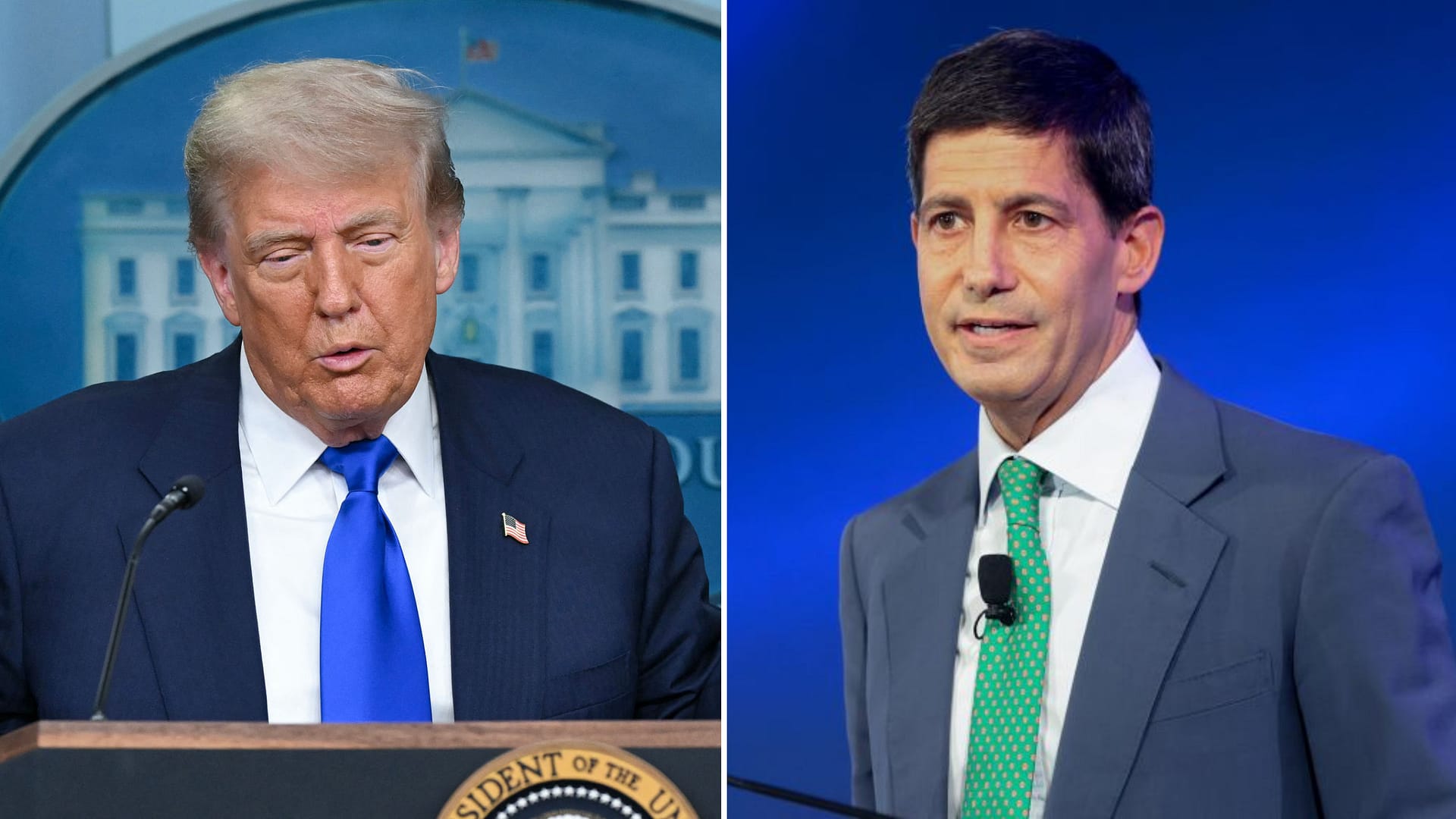

Former U.S. President Donald Trump said that Kevin Warsh would cut interest rates without any external pressure, should he take on the role of Federal Reserve chair, framing the potential policy shift as an independent decision rather than a politically driven move.

The comments have drawn attention as markets remain highly sensitive to signals around future U.S. monetary policy and leadership at the central bank.

Key Takeaways

- Donald Trump said Kevin Warsh would cut rates “without any pressure.”

- The remarks relate to potential leadership at the Federal Reserve.

- Interest rate expectations remain a key market driver.

- Comments highlight ongoing debate over Fed independence.

Trump Comments on Potential Fed Leadership

Speaking publicly, said that Kevin Warsh would pursue interest rate cuts on his own judgment if appointed as Federal Reserve chair. Trump emphasized that such a move would not be the result of political influence.

The remarks come amid heightened scrutiny over how changes in Fed leadership could shape the path of U.S. monetary policy.

Who Is Kevin Warsh?

previously served as a governor at the Federal Reserve and has been a frequent commentator on monetary policy and central bank credibility. He is often viewed as favoring policy approaches that support economic growth while maintaining long-term stability.

Warsh has been mentioned in the past as a potential candidate for senior economic roles in Republican administrations.

Market Sensitivity to Rate-Cut Signals

Any suggestion of future interest rate cuts can have immediate implications for equities, bonds, currencies, and risk assets. Investors closely track statements related to the Federal Reserve, given its central role in shaping global financial conditions.

According to coverage by, even hypothetical scenarios involving Fed leadership can influence expectations around the timing and scale of policy easing.

Fed Independence in Focus

The comments also revive discussion around the independence of the Federal Reserve, a principle widely viewed as critical to maintaining market confidence. While U.S. presidents appoint Fed chairs, the central bank is designed to operate independently of political pressure.

Analysts note that reassurance around decision-making autonomy is often aimed at calming investor concerns.

What To Watch Next

- Further statements from Trump or Kevin Warsh on monetary policy.

- Market reaction to evolving expectations around Fed leadership.

- Upcoming Federal Reserve meetings and rate guidance.

This article is for informational purposes only and does not constitute financial advice.