Digital asset infrastructure provider Talos has raised $45 million in fresh funding, pushing its valuation to approximately $1.5 billion and reinforcing investor confidence in institutional-grade crypto trading technology.

The funding highlights continued demand for platforms that support secure execution, connectivity, and risk management as digital assets become more embedded in traditional finance.

Key Takeaways

- Talos raised $45 million in a new funding round.

- The company’s valuation climbed to about $1.5 billion.

- Investor interest remains strong in crypto market infrastructure.

- Institutional adoption continues to drive capital inflows.

Fresh Capital at Unicorn Valuation

According to reporting by, the latest funding round values at roughly $1.5 billion. The capital injection is expected to support product development and expand the firm’s institutional client base.

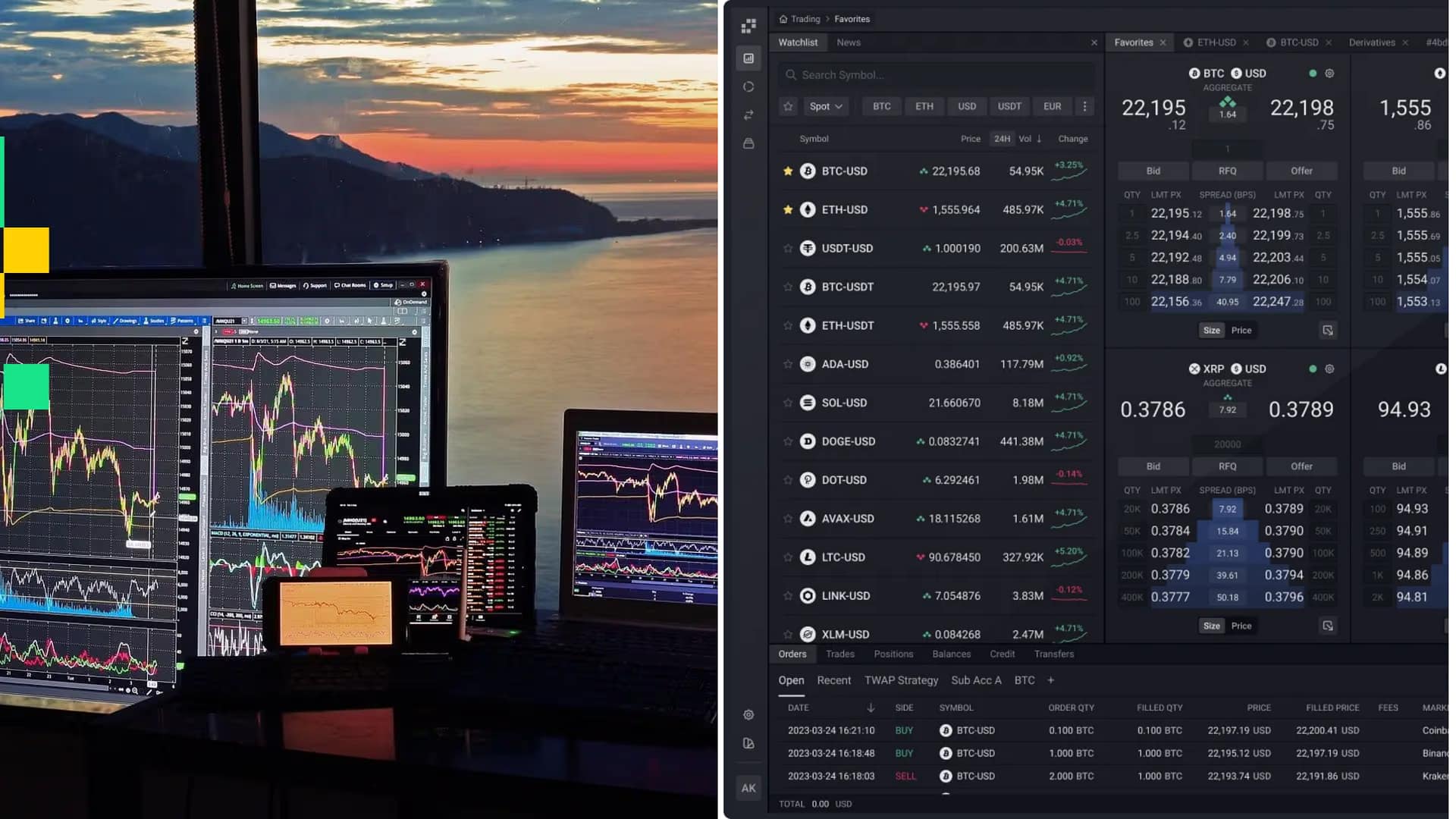

Talos provides trading, settlement, and connectivity solutions designed to help banks, hedge funds, and asset managers access digital asset markets.

Institutional Demand Drives Growth

The raise comes as institutional participation in crypto markets continues to mature, even amid periods of price volatility. Firms like Talos benefit from demand for robust infrastructure that mirrors standards found in traditional financial markets.

Industry observers cited by note that infrastructure providers are often seen as lower-risk bets compared with token issuers or consumer-facing platforms.

Strategic Focus on Market Connectivity

Talos has positioned itself as a neutral layer connecting institutions to exchanges, liquidity providers, and custodians. This approach allows clients to manage execution and risk across fragmented digital asset markets.

The company’s growth strategy reflects a broader trend toward professionalization of crypto trading and post-trade operations.

Funding Signals Confidence in Web3 Backbone

Despite a more selective venture capital environment, sizable rounds for infrastructure firms suggest sustained confidence in the long-term role of blockchain and digital assets. Valuations at this level indicate expectations of continued institutional onboarding.

As regulatory clarity improves in key markets, infrastructure providers are likely to remain central to the ecosystem’s expansion.

What To Watch Next

- How Talos deploys the new capital for expansion and product upgrades.

- Institutional adoption trends across digital asset markets.

- Further funding rounds or strategic partnerships in crypto infrastructure.

This article is for informational purposes only and does not constitute financial advice.

Read Also: Avalanche’s Tokenized Real-World Assets TVL Climbs Past $1.3 Billion