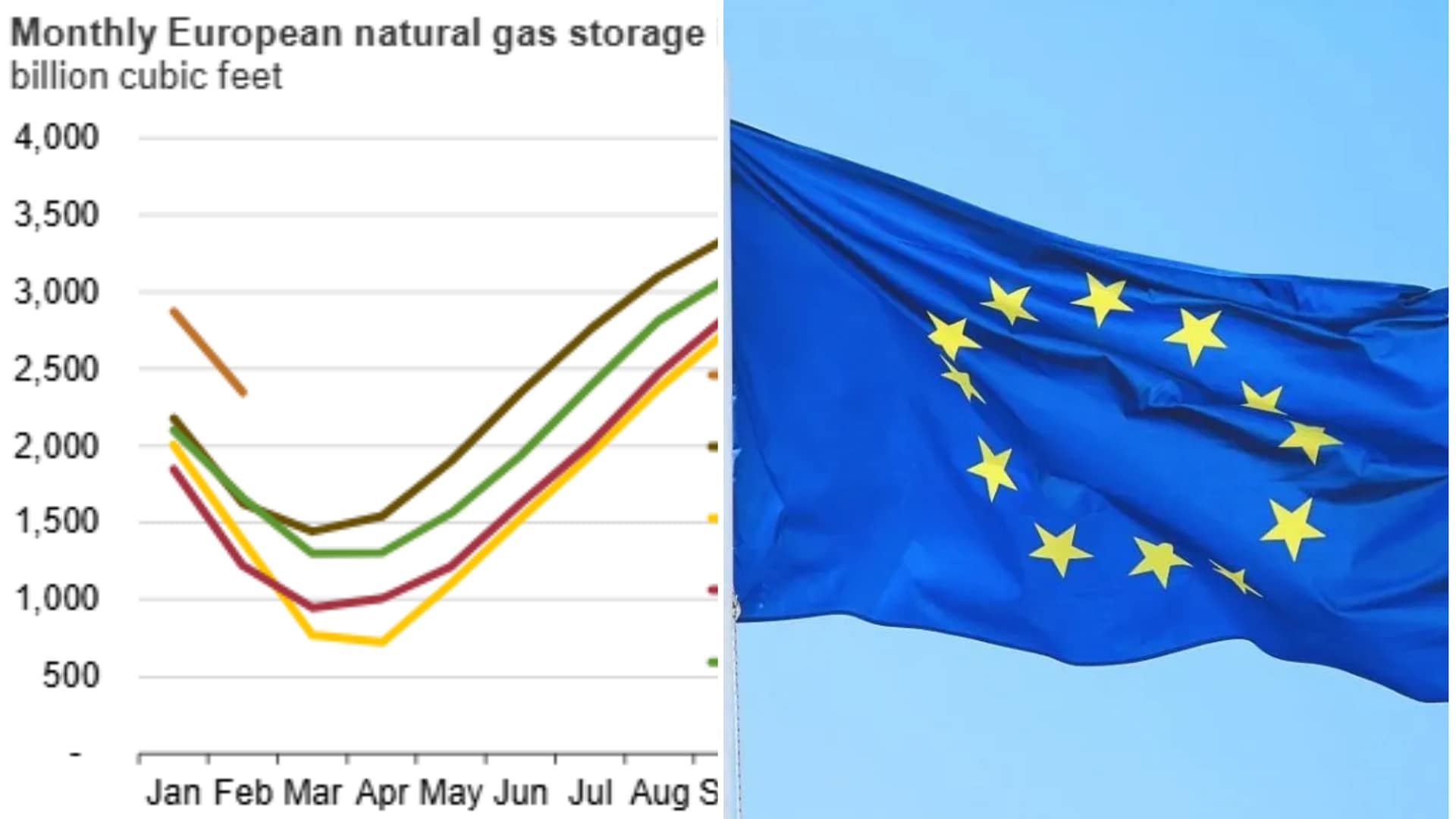

Europe has withdrawn roughly 80% of the gas injected into storage for the current heating season, highlighting the scale of winter demand and renewed pressure on the region’s energy balance. The figures point to a faster-than-average drawdown compared with recent years, raising questions about supply flexibility toward the end of winter.

The data comes amid broader turbulence in global gas markets, as weather-driven disruptions and shifting trade flows reshape supply dynamics across Europe and North America.

Key Takeaways

- Europe has already withdrawn about 80% of gas stored for the heating season.

- Colder weather has accelerated consumption across the region.

- The U.S. redirected gas from LNG exports to domestic use due to severe weather.

- Global LNG availability could tighten if disruptions persist.

European Storage Levels Under Pressure

According to calculations by based on figures from, the majority of gas injected ahead of winter has already been consumed. Storage withdrawals have accelerated during colder spells, underscoring Europe’s ongoing dependence on stored reserves to balance seasonal demand.

Energy analysts note that while storage levels remain above critical thresholds, the pace of withdrawals leaves less margin for prolonged cold weather or unexpected supply disruptions later in the season.

U.S. Weather Disruptions Alter LNG Flows

At the same time, global gas trade has been affected by extreme weather in North America. reported that the United States was forced to redirect natural gas originally intended for liquefaction and export back into its domestic market due to an Arctic cyclone.

Such redirections can temporarily reduce LNG volumes available to international buyers, including Europe, which relies heavily on imports to compensate for limited pipeline supply.

Implications for Global Gas Markets

The combination of strong European withdrawals and constrained LNG exports from the U.S. adds to uncertainty in global gas pricing. Traders are closely watching storage data, weather forecasts, and export volumes for signals on whether supply tightness could intensify.

Market observers cited by international media have warned that even short-lived disruptions can ripple through interconnected gas markets, affecting prices and availability well beyond the regions directly impacted.

Energy Security Remains in Focus

European policymakers continue to emphasize diversification of supply sources and demand management as key pillars of energy security. While storage has played a stabilizing role this winter, the rapid drawdown highlights the importance of steady LNG inflows and mild weather conditions.

As winter progresses, attention will remain on how quickly storage levels decline and whether global supply chains can adapt to sudden shifts in demand.

What To Watch Next

- Daily gas storage withdrawal rates across major European hubs.

- Weather forecasts in Europe and North America.

- U.S. LNG export volumes following the Arctic cyclone.

This article is for informational purposes only and does not constitute financial advice.