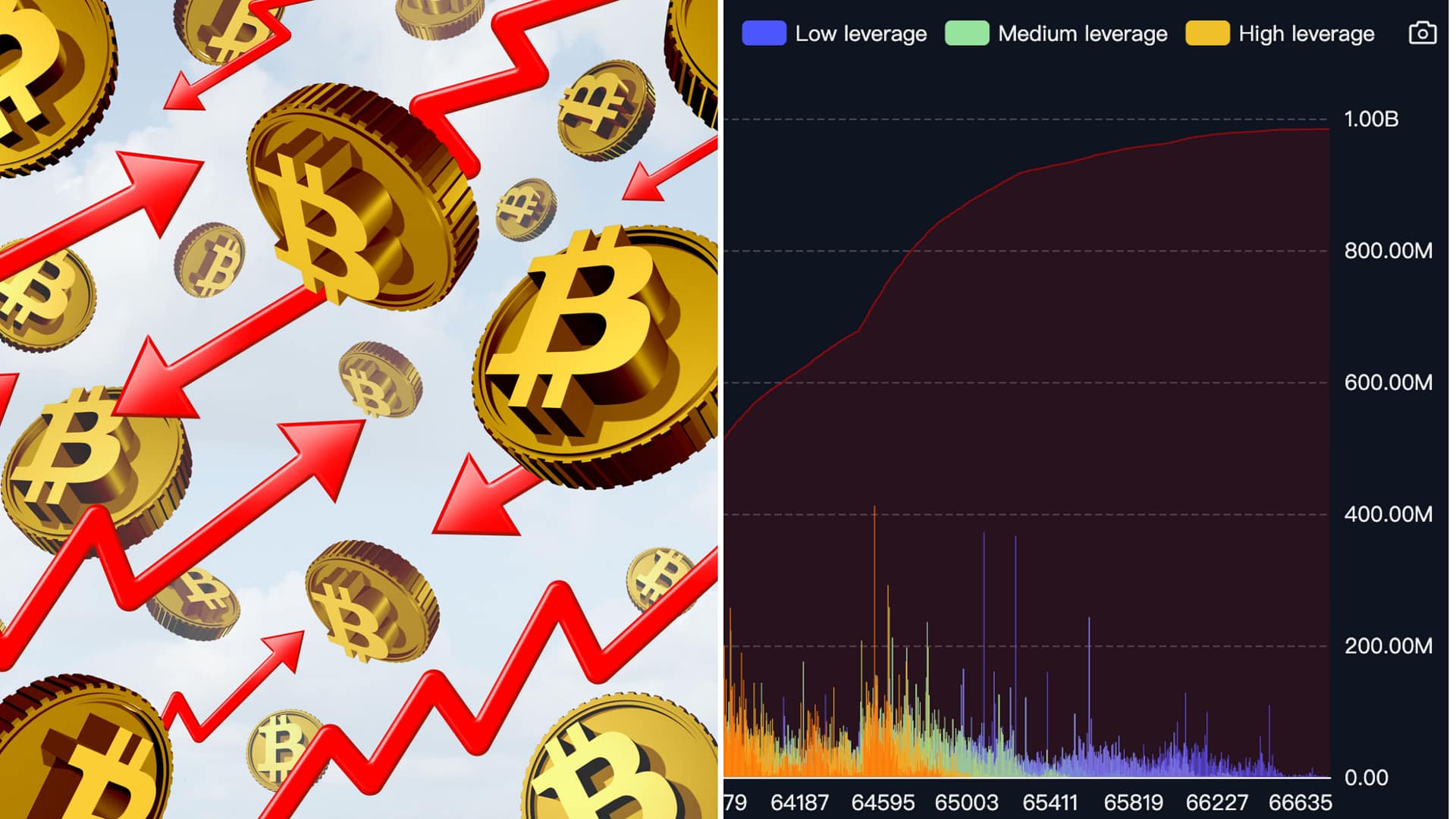

The cryptocurrency market recorded more than $1.7 billion in liquidations over a short trading window as sharp price swings triggered cascading losses across leveraged positions. The spike underscores how sensitive digital asset markets remain to sudden shifts in liquidity and macro-driven sentiment.

Both long and short traders were affected as major assets such as Bitcoin and Ether moved rapidly across key technical levels, amplifying forced position closures on derivatives platforms.

Key Takeaways

- More than $1.7 billion in crypto positions were liquidated during heightened volatility.

- Leveraged long positions accounted for the majority of forced closures.

- Bitcoin and Ether led liquidation volumes across major exchanges.

- Macro uncertainty continues to influence short-term crypto price action.

Volatility Triggers Widespread Liquidations

Market data shows that sudden intraday price movements caused liquidation engines on major exchanges to activate en masse. According to figures cited by, the bulk of liquidations occurred within a few hours, reflecting heavy leverage concentrated around narrow price ranges.

Analysts told that thin liquidity during peak trading hours can exacerbate these moves, turning modest declines into rapid sell-offs.

Bitcoin and Ether Bear the Brunt

Bitcoin and Ether together represented the largest share of liquidated positions, consistent with their dominance in derivatives markets. Futures tied to these assets often carry higher open interest, making them more vulnerable during sudden reversals.

Coverage by noted that algorithmic trading and stop-loss clustering around psychological price levels contributed to the speed of the downturn.

Leverage Remains a Structural Risk

High leverage continues to be a defining feature of crypto derivatives trading. While it allows traders to amplify returns, it also increases the probability of forced liquidation when markets move against positions.

Industry observers have repeatedly warned that excessive leverage can magnify volatility, especially during periods of macro uncertainty involving interest rates, inflation data, and broader risk sentiment.

Macro Signals Add to Market Stress

The liquidation surge coincided with renewed uncertainty across global markets, where investors are closely monitoring economic indicators and central bank signals. Digital assets, often treated as high-risk instruments, tend to react sharply to shifts in macro expectations.

This environment has kept short-term traders on edge, with rapid repositioning adding further instability to price action.

What To Watch Next

- Changes in open interest and leverage ratios across major exchanges.

- Bitcoin and Ether reactions to upcoming macroeconomic data releases.

- Whether volatility subsides or leads to further liquidation cascades.

This article is for informational purposes only and does not constitute financial advice.