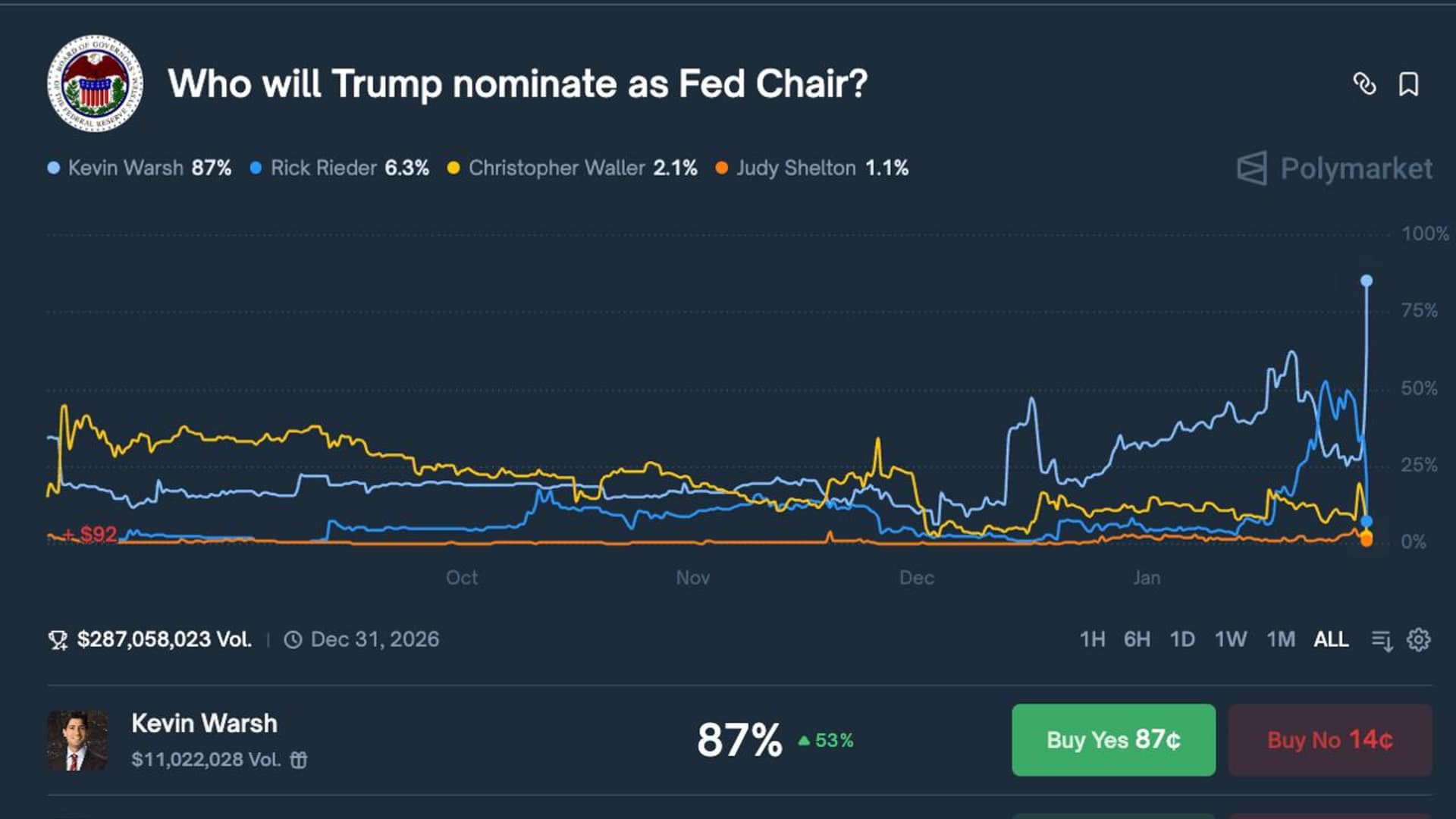

Prediction markets are signaling a strong consensus on who could lead the US Federal Reserve under a potential second Trump administration, with Kevin Warsh emerging as the dominant favorite. Data from Polymarket shows traders assigning Warsh an 87% probability of being nominated as the next Fed Chair.

The sharp imbalance in odds highlights how market participants are increasingly positioning around a single outcome, reflecting both political expectations and views on future monetary policy direction.

Key Takeaways

- Kevin Warsh leads Polymarket odds with an 87% chance of nomination.

- Rick Rieder trails significantly with a 6.3% probability.

- Prediction markets are increasingly used to gauge political and policy outcomes.

- Fed leadership expectations can influence bond and crypto markets.

Polymarket Signals Strong Conviction

According to data from Polymarket, traders have overwhelmingly backed Kevin Warsh as the most likely pick for Fed Chair if Donald Trump returns to the White House. Such a high probability suggests limited disagreement among participants, a notable shift from earlier periods when odds were more dispersed among multiple candidates.

Rick Rieder, the next closest contender, is priced at just 6.3%, underscoring the gap between Warsh and the rest of the field.

Why Markets Are Watching the Fed Chair Race

The identity of the Fed Chair carries major implications for interest rates, inflation control, and financial market liquidity. Analysts frequently note that leadership expectations at the Federal Reserve can move Treasury yields and risk assets well before any official nomination is announced.

Reuters has previously reported that investors closely track potential shifts in Fed leadership as part of broader macroeconomic positioning, especially during election cycles.

Implications for Crypto and Risk Assets

For cryptocurrency markets, a change in Fed leadership is often interpreted through the lens of monetary policy stance. Expectations of tighter or looser policy can affect dollar strength and liquidity conditions, both of which play a role in crypto price dynamics.

While prediction markets do not guarantee outcomes, they increasingly serve as a real-time sentiment gauge for traders across traditional and digital asset markets.

What To Watch Next

- Shifts in Polymarket odds as the US election cycle progresses.

- Public statements or endorsements related to Fed leadership.

- Market reactions in bonds, equities, and crypto tied to policy expectations.

This article is for informational purposes only and does not constitute financial advice.